Why Traditional B2B Sales Doesn’t Work in 2025 (And What To Do Instead)

Why Traditional B2B Sales Doesn’t Work in 2025 (And What To Do Instead)

Imagine you're searching...

According to a recent index of 34,000 SaaS businesses by Paddle, over the last three years, growth has slowed by 50%, customer acquisition cost (CAC) has increased 50%, and customer churn is up 29%. And unfortunately, these concerning trends are projected to continue in the foreseeable future. In short, SaaS companies are struggling to efficiently and effectively grow revenue.

Perhaps the biggest contributing factor to SaaS companies' struggles is that B2B buying has changed dramatically over the last five years and companies are still relying on decades old sales strategies that no longer support a modern buying process.

In this post, we'll take a closer look at four significant changes in B2B buying, the problems each has created for Sales teams, and how Sales teams can adapt to generate revenue efficiently and effectively moving forward.

Let's dive in to the four most significant changes in B2B buying over the last five years.

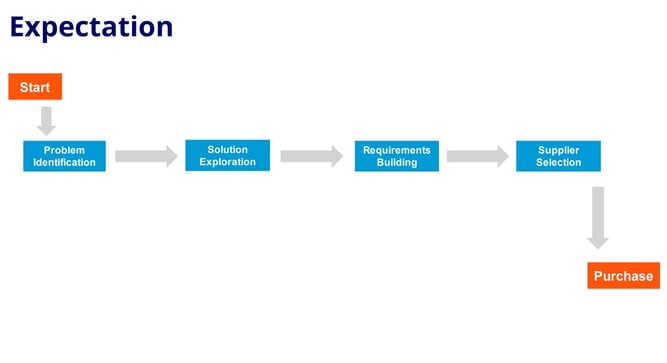

Buying used to be a linear process, largely because the only source of information for the buyer was controlled by Sales, allowing Sales to manage the buyer’s journey. This linear structure made it easier for Sales to monitor the process, and widely adopted tools and playbooks were built around this linear design.

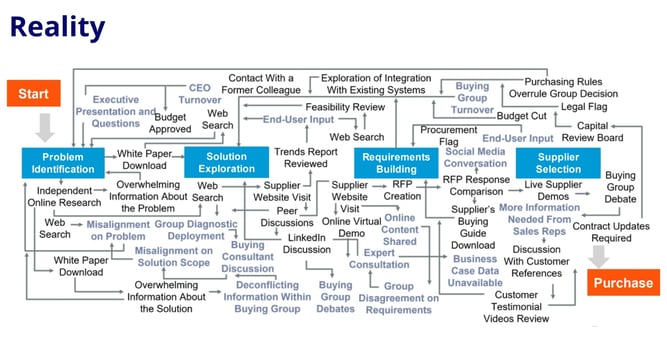

Today, however, the buying process is unavoidably chaotic and unique to each buyer. Buyers go forward and backward in the buying journey multiple times. According to Gartner, 80% of buyers go backward in the process at least once.

To make matters worse, buyers complete many of the steps outlined above outside of a domain owned by the business, giving Sales no visibility into the buyers' progress. More on that in change #2 below...

As mentioned previously, widely adopted Sales tools were created to follow a linear sales process. When asked to monitor today's convoluted buying process, where buyers frequently take steps forward and backward, traditional tools are unable to support it.

Without accurate monitoring of the buying process, two big problems arise.

According to Gartner, the desire for a seller-free buying experience has risen each year since 2020. For Millennials in particular, 72% of buyers preferred seller-free in 2022, and 75% of buyer preferred seller-free in 2023. That figure is predicted to increase to over 90% in the next thee years.

Buyers don’t want to interact with Sales until they’re well down the consideration path (75% according to most studies). Buyers explain that being forced to interact with Sales to receive information critical to their buying decision creates “annoyance and friction.”

Because buyers aren't engaging with Sales until it's necessary, Sales has less access to buyers than ever before. Sales has lost control over the buying process, leading to major problems:

Ten years ago, the average buying committee included 5.4 members. Today, the average is 14 members and rising. In most cases, Sales likely won't interact with each member, yet still need to make sure each member has access to the information relevant to their role in the buying committee.

Each additional member of a buying committee adds to Sales teams' challenges:

Today's buyers expect transparency during their evaluation process. They want to know how the product works, see what it looks like, experience it in action, and understand the value the product will bring to their business before putting any dollars on the table. This desire to be 100% confident in their purchase is due to buyers having limited budgets and past experiences of buyer regret.

Note: "Try-before-you-buy" does not translate directly to offering a free version or trial period of your product. Not all products are suited (or businesses are ready) to use that GTM strategy. Instead, try-before-you-buy refers to demonstrating value and providing insight into the product early in the buying process using tools like interactive demos. In fact, simply handing the keys to a product over to buyers without any guidance is 21% more likely to lead to buyer regret!

Buyers become skeptical when they're asked to "chat" or "meet" with Sales before getting even a glimpse into the product, and will navigate to a competitor that can answer their questions now. And the data shows it -- 81% of request forms are abandoned. No one likes the feeling that someone is looking over their shoulder while they evaluate a purchase.

Simply put, not providing insight into your product early in the sales cycle will drive your buyers to your competition.

The B2B marketplace has changed from seller-centric to buyer-centric. To adapt to a messy, non-linear buying process, driven by a larger buying committee that doesn't want to engage with Sales, yet demands insight into the product, what can Sales do?

The answer is to provide buyers with a channel Sales owns that:

By providing buyers with an asynchronous channel that matches how they prefer to buy, in an environment Sales controls, Sales receives insights into what each member of the buying committee is interested in / cares about and where buyers are in their learning/evaluation process. Detailed insight allows Sales to intervene when necessary to mitigate risk, build buyer confidence, and guide buyers down the decision journey.

It's clear that the traditional Sales methodologies used in the last decade are no longer effective in the B2B landscape today. Reports of high CAC, slow growth, and high churn are all indicators that existing sales tactics do not drive efficient growth. And as investors today are prioritizing profitability over growth-at-all-costs, the need for efficient growth is even more intense.

If your plan to achieve efficient growth in 2025 is to increase the volume of what you're already doing – more sales people, more seller-centric tech, more training – without changing any of your GTM strategy, we wish you all the best.

If you’re tired of doing the same thing you’ve done in the past five years, and tired of seeing the same results quarter after quarter, we encourage you to try a new, proven approach: empowering your buyers.

Omedym's unique approach to buyer enablement is used by customers large and small to see results within weeks, not months. Let us help you end 2024 on a positive note and build a sustainable foundation for profitable growth in 2025 and beyond.

Watch how PRAOS Health uses buyer-centric digital sales rooms to win more deals, faster. Click here to view the video.

Schedule a chat with a member of the Omedym team or explore our interactive demo.

Read what Omedym customers have to say about their experiences with the platform on G2.

Imagine you're searching...

In today’s B2B environment, sales...

.jpg)